ESIC Online Payment | ESIC Online e-Challan Payment | ESIC Online Payment Print Receipt | e-Challan Payment Login

Employees’ State Insurance Act, 1948(ESI Act) ensures social security for workers in India. Any Health-related or Financial crises situation that the workers are commonly exposed to, such as

- sickness,

- maternity,

- temporary or permanent disablement,

- Occupational disease,

- Death due to employment injury,

The above situations result in loss of wages or earning capacity total or partial.

To overcome the situations mentioned above, the Central Government of India started ESIC(Employees’ State Insurance Corporation) scheme.

Through Employee’s State Insurance Scheme, The Central Government of India delivers various services to employers and workers via its official information portal & service portal.

Read Also:—-> What Is Unified Pension Scheme 2025

Details of ESIC Collection of Contribution

The ESIC Scheme being contributory in nature, Employers and workers (employees) need to contribute to the employee’s State Insurance to get benefits from the ESIC scheme.

Employers and workers need to pay a small share of their income at the ESIC’s specified Contribution rate. The rates are revised from time to time by Government of India. Currently,

- For employee’s contribution rate (FY 2024-25) is 0.75% of the salaries,

- For employers, The Contribution rate is 3.25% of the salaries paid/payable in respect of the employees in every salary period.

Employees (Workers) whose daily average income is up to Rs.137/, no need to pay (such employees are exempted). Employers will contribute their share in respect of such employees.

Also Read:—> Ayushman Card List

Contribution Period and Benefit Period of ESIC

An employer is accountable to pay his contribution in respect of every worker. As per guidelines employer shall pay these contributions at the above-specified rates to the ESIC within 15 days of the last day of the Calendar month.

The Employees’ State Insurance Corporation has authorized specified branches of the State Bank of India and a few other banks to receive the payments on its behalf.

There are two contribution periods each of six months duration and two corresponding benefit periods also of six months duration as follow-

| Contribution Period | Cash Benefit Period |

| 1st April to 30th September. | 1st Jan of the following year to 30th June |

| 1st Oct to 31st March of the year following. | 1st July to 31st December. |

ESIC Online Payment: Now, ESIC provides an online payment facility to all beneficiaries through e-Challan. All the beneficiaries can now contribute online through the official ESIC Portal.

Here we will provide all the crucial information about ESIC online payment procedure. Also, You will get all the essential details of ESIC online payment 2024-25 via this article, i.e., objective, official portal information, benefits, features, login, e Challan payment, print receipt, etc.

So if you are from one of the beneficiaries (an employer or worker) and wants to contribute to the employee’s State Insurance, stick with us to get complete details regarding payment of e Challan under ESIC online payments.

Also Read:—-> CRCS Sahara Refund Portal

About ESIC Online Payment 2024-25

The Employee’s State Insurance Corporation has allowed its beneficiaries to pay their share using e-Challan online. Employees State Insurance Corporation is an autonomous organization of the Government of India, which ensures health insurance and social security scheme for workers.

Employers and workers who have a net banking facility now can make ESIC online payments (pay through e-Challan) on official portal.

For ESIC online payments, You (Beneficiaries of ESIC with Net banking facility) don’t need to visit any government offices physically. It (ESIC online payment using e-Challan) will save a lot of time and effort.

In order to make ESIC online payments through e-Challan, all the beneficiaries require:

- Net banking facility.

- “User id” and “password” for ESIC service portal

Key Highlights Of ESIC Online Payment 2024-25

| Name Of The Scheme | ESIC Online Payment through e-Challan 2024-25 |

| Launched By | Central Government scheme (India) |

| Ministry | ministry of labour and employment |

| Beneficiary of the scheme | Workers (People of India) |

| Objective of ESIC Scheme | Provide Facility Of Payment Online through e-Challan |

| Official Website for Information | Visit Here |

| Official Website for service | Visit Here |

| Year | 2024-2025 |

| Mode Of Payment | Online through e-Challan |

Procedure To Make ESIC Payment Online

if you are one of the beneficiaries of the ESIC scheme and want to make ESIC Payment online through e-Challan, Then you must follow the process-

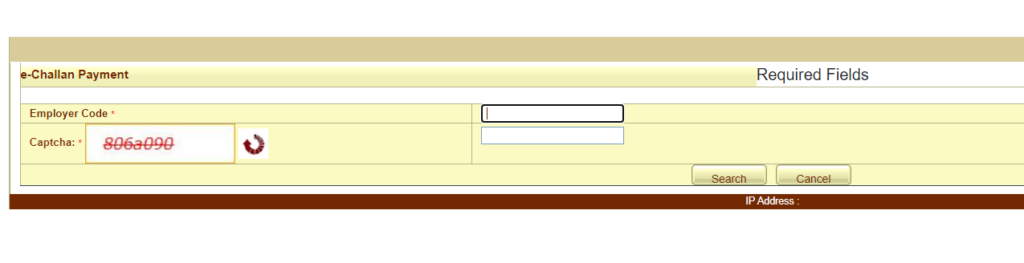

- First, you need to visit the official Service Portal of ESIC.

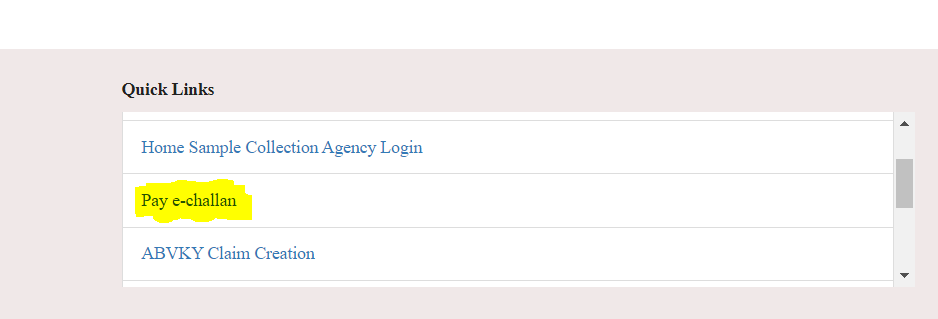

- You have to scroll down and find the “Quick Links” section on the homepage.

- Inside the “Quick Links” section, you need to click on the “pay e-Challan” option.

- By doing so, you will be redirected to a new page.

- You have to provide the employer code on this new page and then verify the captcha code.

- Next, you have to click on the “search” button.

- After that, you have an e-Challan number on the screen, note that number for future use, then click on continue for payment.

- Next, you have to select your bank for payment through internet banking.

- After that, you have to provide your accurate details like user ID with your Net banking credentials to proceed with payment.

- Next, you have to click on the “pay” Option.

- Once the payment process is done successfully, the Payment success confirmation with receipt will appear on your screen.

- Next, You have to click on the “print” option to take Print out of the receipt and keep the receipt for future use.

Procedure To View ESIC Dashboard

if you are one of the beneficiaries of the ESIC scheme and want to view Dashboard, Then you must follow the process-

- First, you need to visit the official service portal of ESIC.

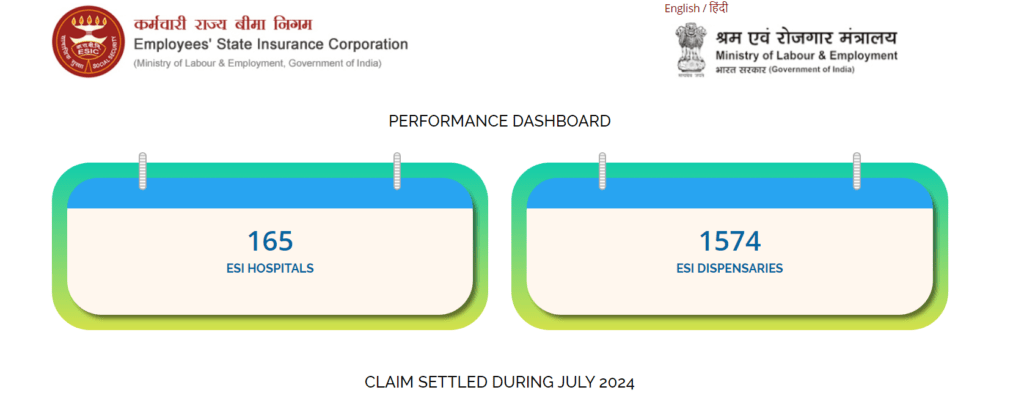

- On the “home page”, please navigate & click on “Dashboard” option in the main navigation.

- Next, you have to click on the ” ESIC Dashboard” option.

- By doing so, you will be redirected to a new page.

- On this new page, you can view the “ESIC Performance dashboard”.

Procedure To View ESIC Directory

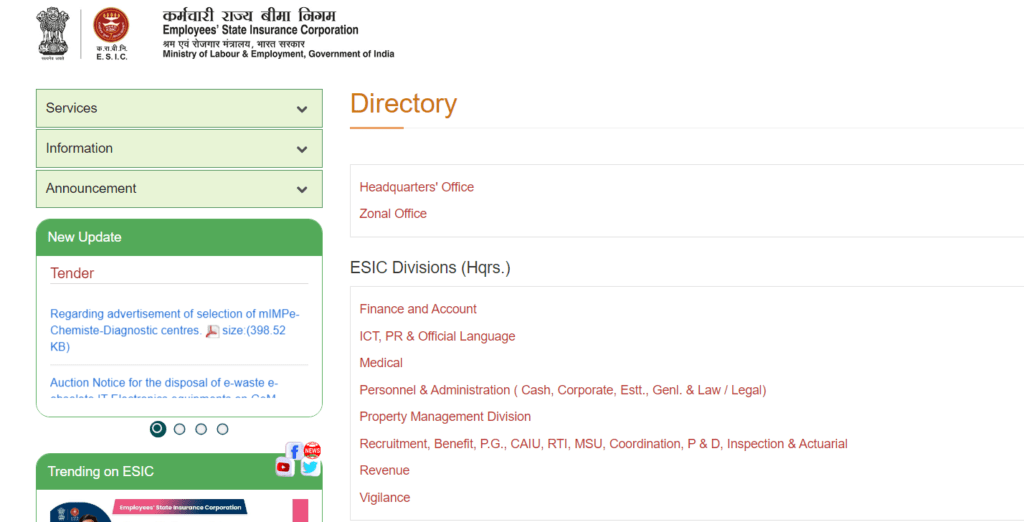

If you want to view the Directory at the ESIC Information portal, then you must follow the process-

- First, you need to visit the official information portal of ESIC.

- On the “home page”, please find out “Information” option in the left sidebar.

- Next, you have to click on the “Information” option.

- After that, you will have to click on the “directory” option.

- By doing so, you will be redirected to a new page.

- Here you can see the Directory.

View Instructions, Circulars & Orders AT ESIC Portal

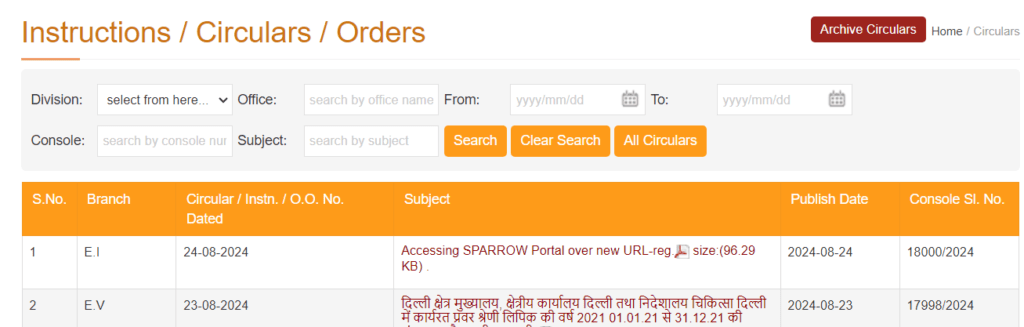

If you want to read official Circulars, Instructions & Orders at the ESIC portal, then you must follow the process-

- First, you need to visit the official information portal of ESIC.

- On the “home page”, please find out “Announcement” option in the left sidebar.

- Next, you have to click on the “Announcement” option.

- After that, you have to click on instructions, circulars & orders.

- By doing so, you will be redirected to a new page.

- Here you will find the list of all the circulars, instructions & orders.

- You can also search for circulars, instructions & orders by selecting the division name & providing details of “Office”, “Console number”, “Subject” date wise by selecting dates.

- The list will appear on the screen.

View / Search Defaulters List At ESIC Portal

If you want to view / Search Defaulters List at the ESIC portal, then you must follow the process-

- First, you need to visit the official information portal of ESIC.

- On the “home page”, please find out “Announcement” option in the left sidebar.

- Next, you have to click on the “Announcement” option.

- After that, you have to click on the defaulters list.

- By doing so, you will be redirected to a new page.

- Here you will find the “Defaulter’s List”.

- You can also search for “Defaulter’s List” by providing details of “Office”, “Console number”, date wise by selecting dates.

- Required information will appear on your screen.

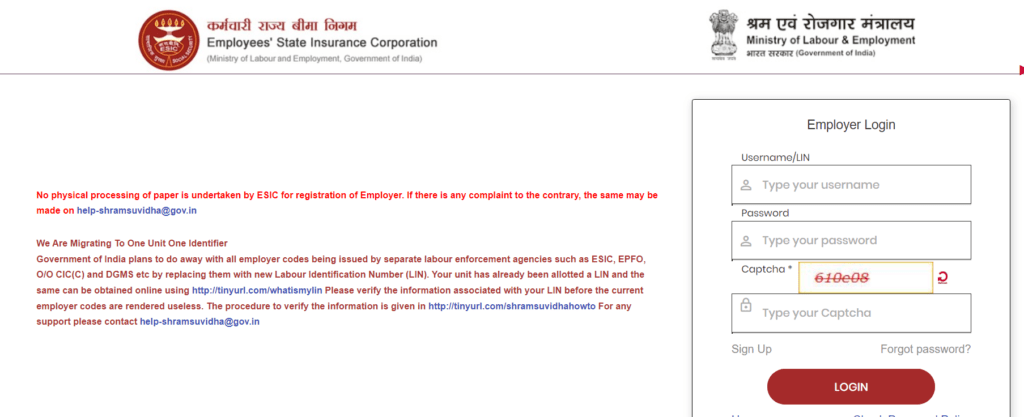

Procedure To Do Employer Login at ESIC Portal

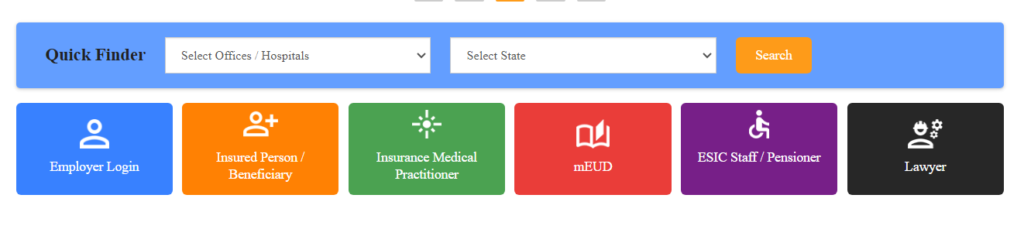

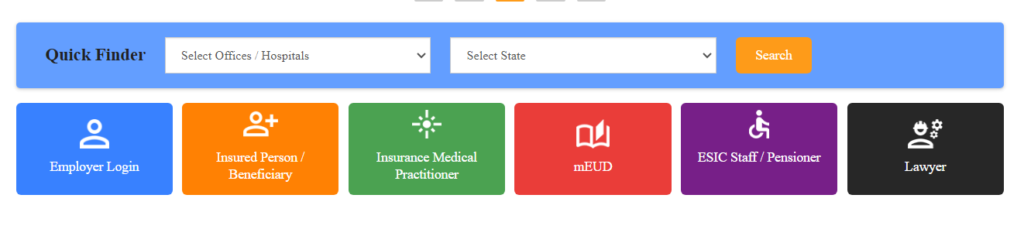

If you want to log in at ESIC Portal as an “Employer”, then you must follow the process-

- First, you need to visit the official Employer portal of ESIC.

- You need to scroll down and find “Employer Login” on the home page”.

- Next, click on the “Employer Login”.

- By doing so, you will be redirected to a new page, “Employer Login”.

- After that, you need to provide a valid username and password with captcha code verification. Then click on the “Login” button.

- By doing so, you will be logged in successfully in your as an Employer at the ESIC portal.

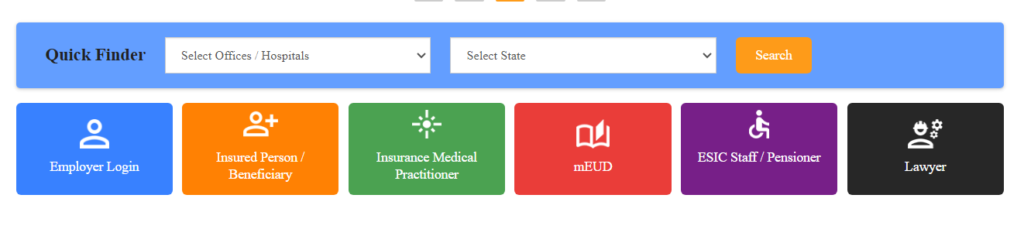

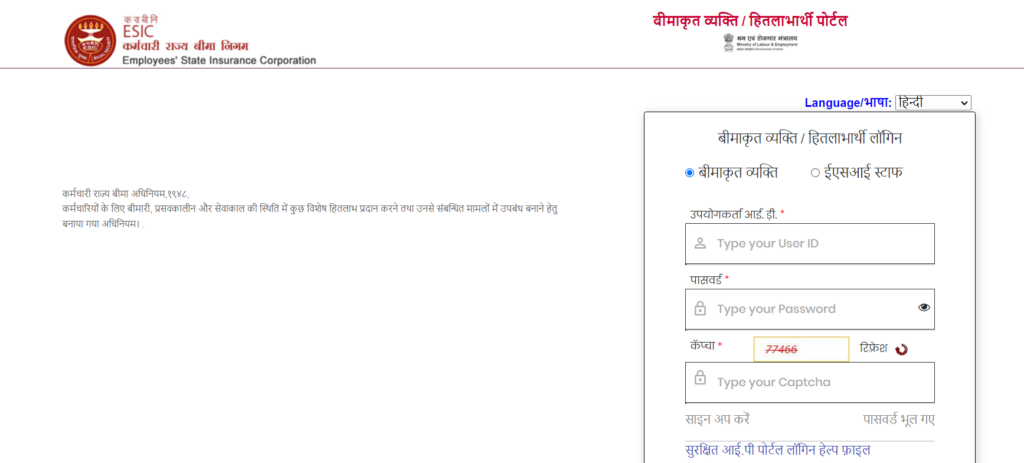

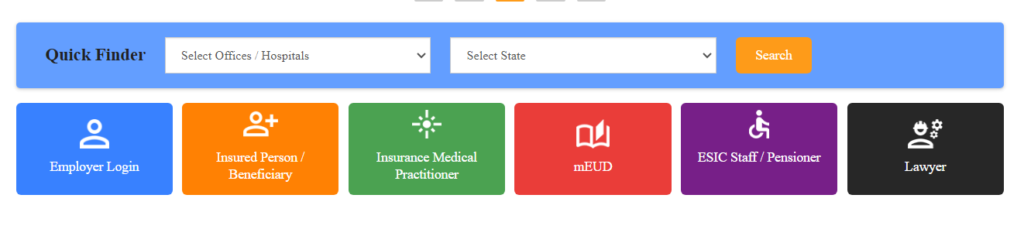

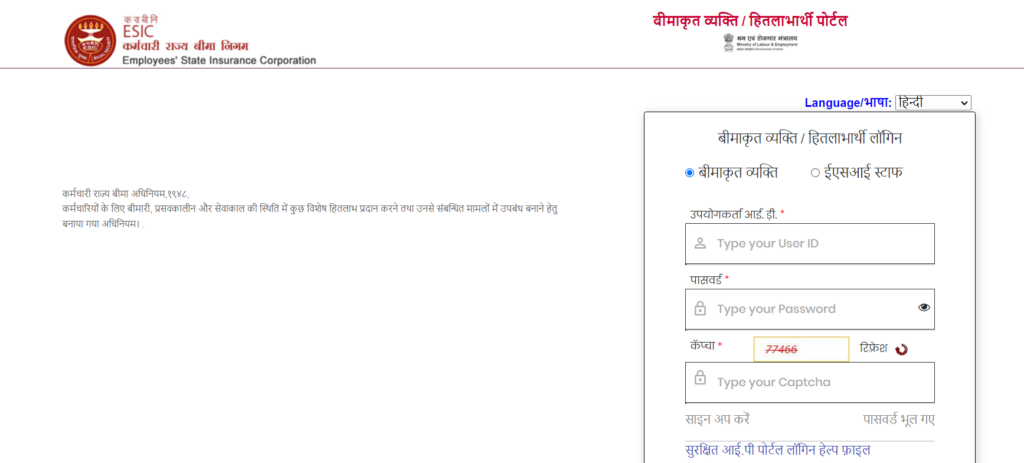

Do Insured Person/Beneficiary Login at ESIC portal( Login as an employee or worker)

If you want to log in at ESIC Portal as an “Insured Person/Beneficiary” (or as a worker), then you must follow the process-

- First, you need to visit the official Employer portal of ESIC.

- You need to scroll down and find “Insured Person/Beneficiary” on the home page”.

- Next, click on the “Insured Person/Beneficiary”.

- By doing so, you will be redirected to a new page, “Insured Person/Beneficiary Login”.

- After that, you need to provide a valid username and password with captcha code verification. Then click on the “Login” button.

- By doing so, you will be logged in successfully in your as an Insured Person/Beneficiary at the ESIC portal.

Procedure of Insurance Medical Practitioner Login at ESIC Portal

If you want to log in at ESIC Portal as an “Insurance Medical Practitioner,” then you must follow the process-

- First, you need to visit the official Employer portal of ESIC.

- You need to scroll down and find “Insurance Medical Practitioner” on the home page.”

- Next, click on the “Insurance Medical Practitioner.”

- By doing so, you will be redirected to a new page, “Insurance Medical Practitioner Login.”

- After that, you need to provide a valid username and password with captcha code verification. Then click on the “Login” button.

- By doing so, you will be logged in successfully in your as an Insurance Medical Practitioner at the ESIC portal.

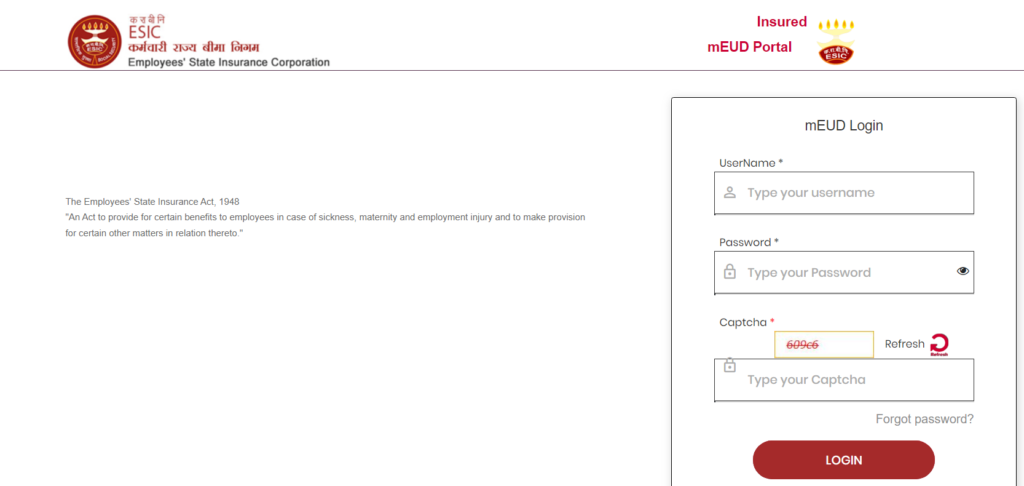

Procedure To Do mEUD Login at ESIC Portal

If you want to log in at ESIC Portal as a “mEUD,” then you must follow the process-

- First, you need to visit the official Employer portal of ESIC.

- You need to scroll down and find “mEUD” on the home page.”

- Next, click on the “mEUD.”

- By doing so, you will be redirected to a new page, “mEUD Login.”

- After that, you need to provide a valid username and password. Then click on the “Login” button.

- By doing so, you will be logged in successfully in your as “mEUD” at the ESIC portal.

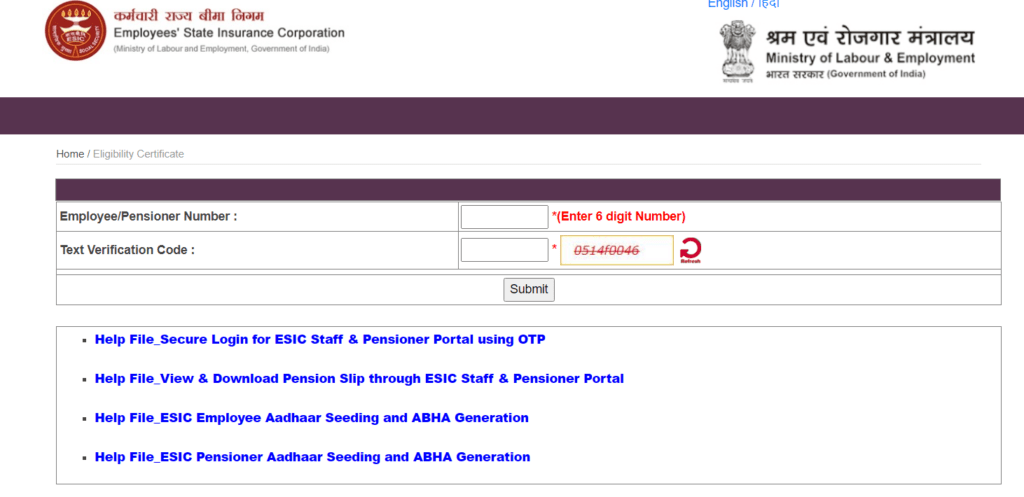

Procedure To Check staff (employee) / Pensioner Medical Eligibility at ESIC portal

If you want to check ESIC staff / Pensioner medical eligibility, then you must follow the process-

- First, you need to visit the official Employer portal of ESIC.

- You need to scroll down and find “ESIC staff / Pensioner” on the home page.”

- Next, click on the “ESIC staff / Pensioner.”

- By doing so, you will be redirected to a new page, “ESIC staff / Pensioner medical eligibility.”

- You have to provide a valid Staff /Pensioner Number with captcha code verification. Then click on the “search” button,

- By doing so, you will get the medical eligibility of that staff/ Pensioner.

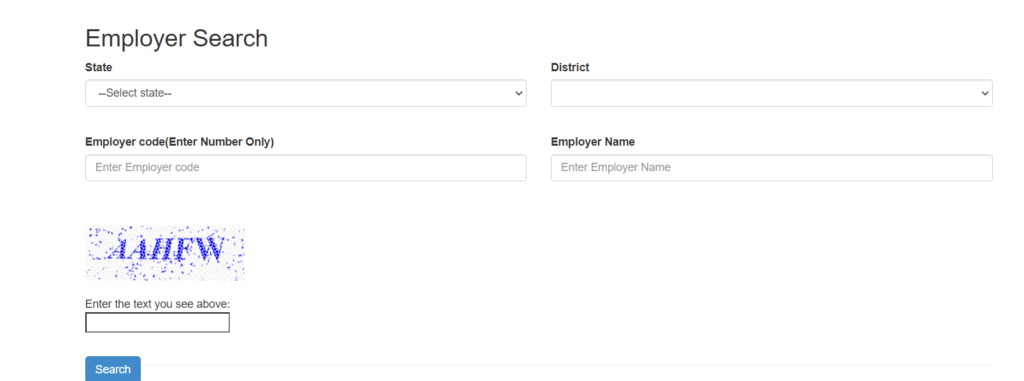

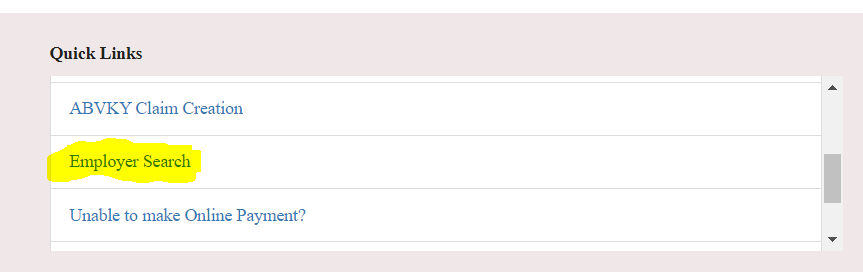

Procedure To Do Employer Search at ESIC Portal

If you want to do an Employer Search at the ESIC service portal, Then you must follow the process-

- First, you need to visit the official Service Portal of ESIC.

- You have to scroll down and find the “Quick Links” section on the homepage.

- Inside the “Quick Links” section, you need to click on the “Employer Search” option.

- By doing so, you will be redirected to a new page, “Employer Search“.

- Now you have to select “State” with “District” from the drop-down list, and then you need to provide “Employer code” & “Employer Name” with valid captcha code.

- After that, you need to click on the “search” button.

- Required information will appear before you.

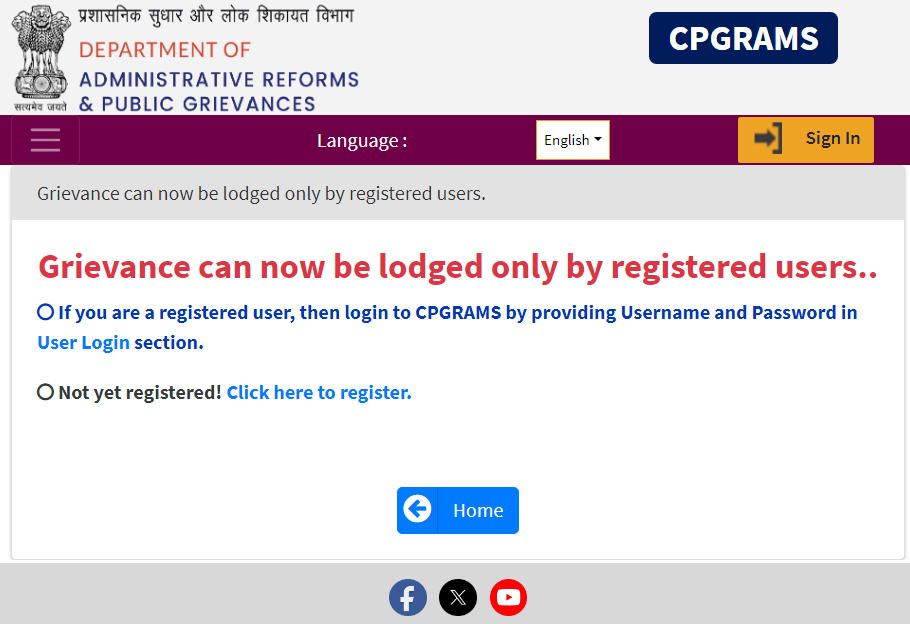

Lodge Grievance / File complaint at ESIC Portal

If you want to file a complaint at the ESIC service portal, Then you must follow the process-

- First, you need to visit the official Service Portal of ESIC.

- Next, you have to find the “Public Grievance” option in the main navigation.

- Hover on the “Public Grievance” option a drop-down menu will open.

- Now you need to click on the “Lodge a Grievance” option.

- A pop-up will appear on the screen.

- Now you have to click on proceed button.

- By doing so, you will be redirected to the new department of administrative reforms and public grievances portal.

- Next, you have to find the “Grievance” option in the main navigation.

- You can Hover on the “Public Grievance” option a drop-down menu will open.

- you will get 5 option “Lodge Public Grievance”, “Lodge Pension Grievance”, “View status”, “Reminder Clarification” & “Rate Grievance”.

- Click on your Grievance type either “Lodge Public Grievance” or “Lodge Pension Grievance”.

- If you are not registered with the department of administrative reforms and public grievances portal, you first need to register yourself on this portal.

- First, you need to log in to your account with a valid credential.

- In section “Grievance Detail“, select “Others/Not Listed/Not Known”.

- Next, In the “Ministry/Department” Drop Down, Select “ESIC”.

- In “Subordinate Department/Office”, select the “Regional Office”.

- Provide details of the complaint.

- Provide any other required information related to your complaint.

- After that, you need to click on “Proceed” or “Submit”.

By doing so, you will get a “Grievance number” or “Complaint Number” please note down that number for future use.

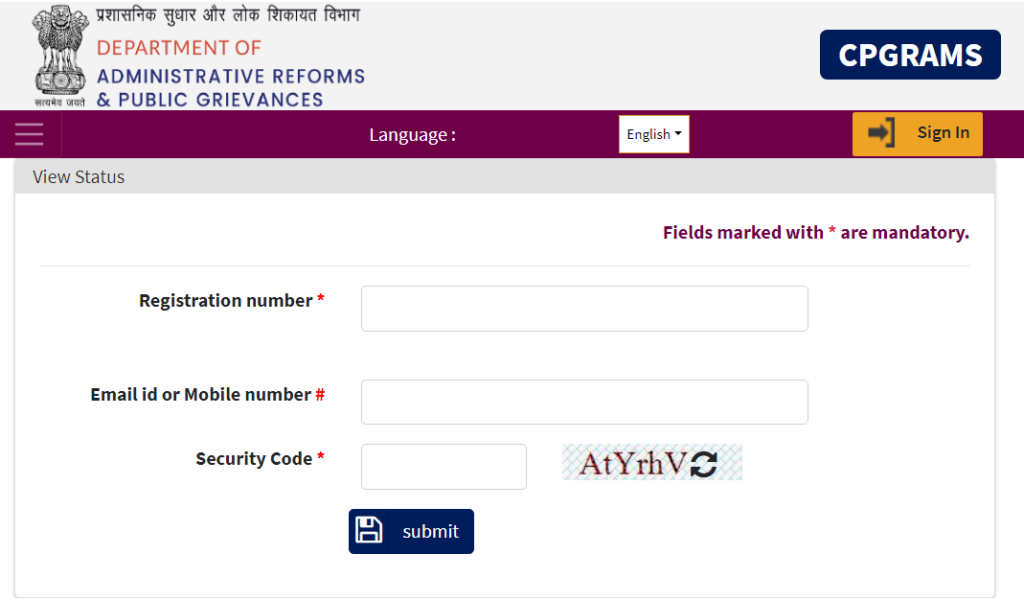

View Grievance Status at ESIC Portal

If you want to view Grievance Status at ESIC portal, then you must follow the process-

- First, You need to visit the department of administrative reforms and the public grievances portal.

- Next, you have to find the “Grievance” option in the main navigation.

- You can Hover on the “Public Grievance” option a drop-down menu will open.

- After that, you need to click on “View status.”

- Next, you need to provide “Complaint registration number” with your “email-id” or “mobile number” and verify the captcha code and then click on the “Submit” button.

- By doing so, your “Grievance status” will appear on the screen.

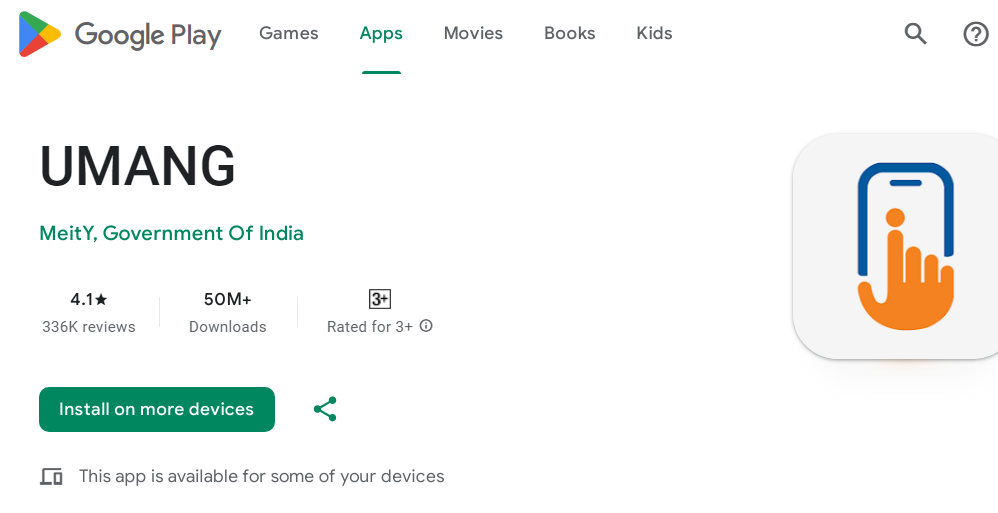

Procedure To Download ESIC Umang Mobile App

If you want to download ESIC Umang Mobile App, then you must follow the process-

- First, You need to visit the official Portal of the ESIC.

- On the Home page, you have to go on top right corner of page, here you will find the “download using app store” option. You have to click on that option.

- By doing so, you will be redirected to the Umang app google play app store download page.

- Next, you have to click on “install” button. By doing so, you can download the Umang app.

- Or for android users, you can directly visit the Google play app store Umang App download page By clicking here.

- Next, you have to click on “install” button. By doing so, you can download the Umang app.

- Or for apple(iPhone and iPad users) users, you can directly visit the Apple app store Umang App download page By Clicking here.

- Users with Windows platform can directly visit the Windows app store Umang App download page by clicking here.

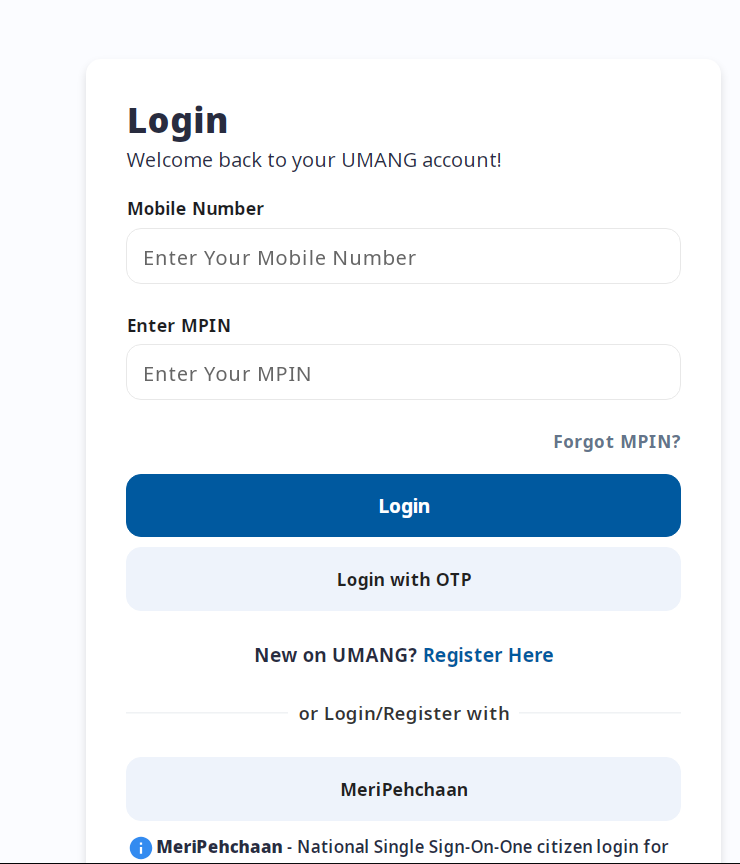

- For web platform( User with Desktop, Laptop or Mac system), you can directly access the Umang web platform service By clicking here. After that you have to click on “Login/ Register” option at the Portal.

- By doing so, you will be redirected “Login page” Of Umang web Platform.

- If you are new to the app then you need to register first.

- If you are already registered with the ESIC Umang app, Then you can log in with the help of your mobile Number & MPIN or OTP. By doing so, you can access all the services on your device(Mobile, Laptop or Desktop).

Get Contact Details at ESIC Portal

To check the contact details at ESIC Portal you need to follow the below procss-

- First, you have to the official website of ESIC.

- On the top navigation of the home page, you need to find the” contact us” option. Click on that.

- By doing so, you will be redirected to the “Contact us” page at ESIC’s official portal. On this page, you can have all the contact details as on official ESIC Portal-

| Address: | Employees’ State Insurance Corporation Panchdeep Bhawan Comrade Indrajeet Gupta (CIG) Marg, New Delhi – 110 002. |

| Phone: | 011-23239333 (EPABX) |

| Toll-Free: | 1800-11-2526 1800-11-3839 (For Medical related queries/advice) |

| E-Mails:- | |

| (i) For Suggestions/Grievances | pg-hqrs[at]esic[dot]nic[dot]in |

| (ii) For Information Technology (IT) related issues | itcare[at]esic[dot]nic[dot]in |

| (iii) For Website “www.esic.nic.in” related communications | website[at]esic[dot]nic[dot]in |

| Websites: | |

| (i) For General Information(s) | https://www.esic.nic.in/ |

| (ii) For Online Application | https://www.esic.in/ |

| Telephone Directory | ESIC Telephone Directory – Updated till 31st Aug, 2021. |

FAQ

How can I pay a challan for ESIC online?

First, you need to visit the official Service Portal of ESIC.

You have to scroll down and find the “Quick Links” section on the homepage.Inside the “Quick Links” section, you need to click on the “pay e-Challan” option.

By doing so, you will be redirected to a new page.

You have to provide the employer code on this new page and then verify the captcha code.

Next, you have to click on the “search” button.

After that, you have an e-Challan number on the screen, note that number for future use, then click on continue for payment.

Next, you have to select your bank for payment through internet banking.

After that, you have to provide your accurate details like user ID with your Net banking credentials to proceed with payment.

Next, you have to click on the “pay” Option.

Once the payment process is done successfully, the Payment success confirmation with receipt will appear on your screen.

What is the last date of payment of ESIC challan?

As per guidelines employer shall pay these contributions at the above-specified rates to the ESIC within 15 days of the last day of the Calendar month.